Archive

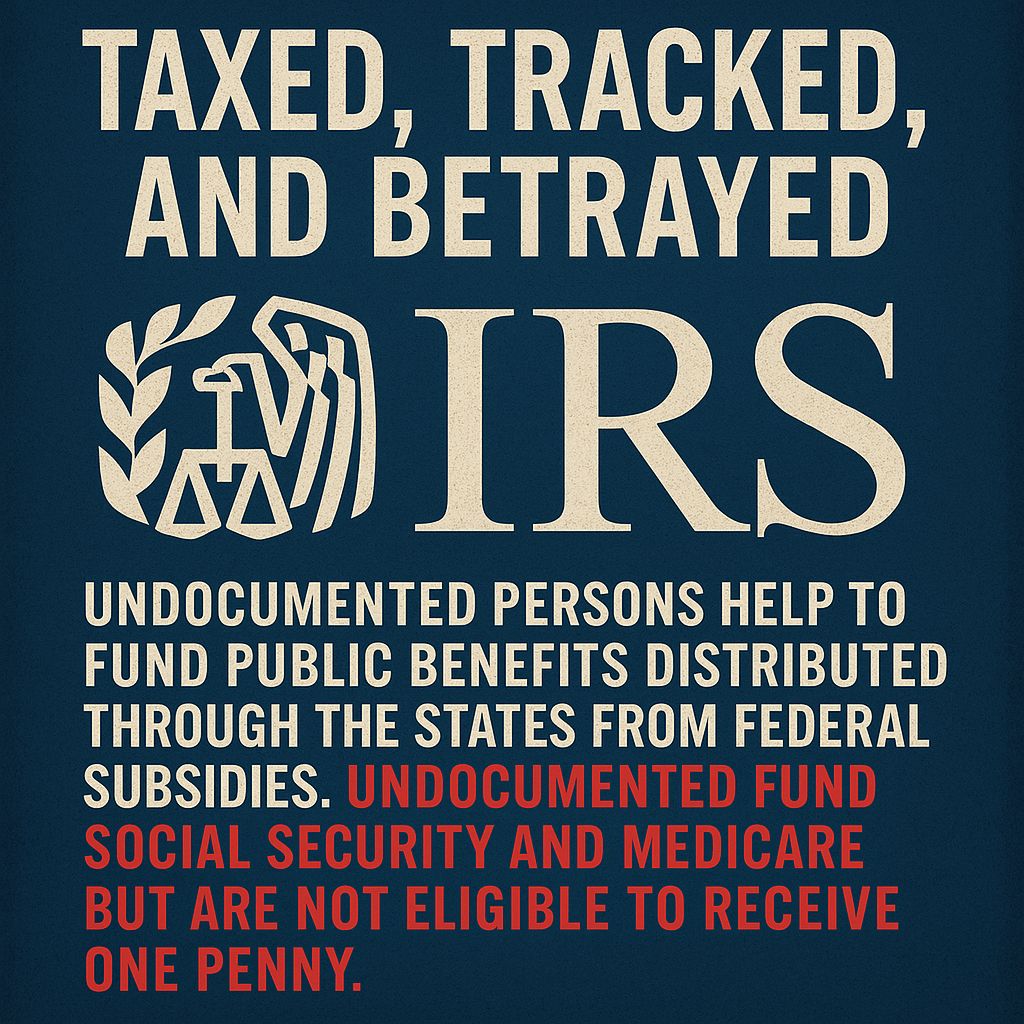

Taxed, Tracked, and Betrayed: The IRS, Immigrants, and the Broken Promise of Privacy

By Marivel Guzman | Akashma News

For decades, undocumented immigrants have been blamed for draining public resources while supposedly avoiding any financial contribution to the tax system. This narrative, fueled by political rhetoric and media simplifications, has helped justify harsh immigration enforcement and rising anti-immigrant sentiment. But the numbers—and the lived experiences—tell a starkly different story.

A Myth of Dependency

The claim that undocumented immigrants exploit U.S. public benefits without contributing is not only misleading—it’s demonstrably false. In 2022 alone, undocumented immigrants contributed nearly $100 billion in federal, state, and local taxes, according to ITEP. These taxes include sales taxes, property taxes (often through rent), and most importantly, payroll taxes such as Social Security and Medicare—benefits they are categorically excluded from receiving.

Far from being a financial burden, undocumented workers help fund programs that millions of Americans rely on, but they are denied access to these same programs. They do not qualify for Social Security retirement benefits or Medicare coverage, despite years—sometimes decades—of wage-based contributions through their paychecks.

The Role of the ITIN: A Deal of Trust

In order to file taxes, undocumented individuals must apply for an Individual Taxpayer Identification Number (ITIN). For years, the IRS encouraged this practice, emphasizing that tax data would remain confidential and would not be shared with immigration authorities. The promise: contribute to the nation, obey tax laws, and your privacy will be protected.

According to the IRS, taxpayers have a “Right to Privacy” and “Right to Confidentiality.” These include protections against intrusive investigations and assurance that personal information—addresses, bank accounts, financial disclosures—will not be shared arbitrarily.

But that promise has now been broken.

Data Sharing: A Betrayal of Trust

Court records reveal a disturbing deal: the IRS has agreed to share tax data with immigration authorities under pressure from the Trump administration, despite the agency’s long-standing assurance that it would not do so. This unprecedented agreement could hand over the private information of millions of immigrants to the Department of Homeland Security, setting the stage for widespread deportation efforts. (USA Today, 2025)

In protest, a top IRS official resigned, calling the move a betrayal of the public trust. As PBS reported, the resignation underscores just how serious this violation of policy and principle is—an action that could chill future voluntary tax compliance and create dangerous precedents for civil liberties.

Scapegoating for Political Gain

Undocumented immigrants have long been the scapegoats of every administration—used as political pawns in debates over crime, jobs, and welfare. But research from the National Academies shows that minority and immigrant families do not dominate welfare rolls—a narrative often perpetuated without evidence. White families have historically accounted for a substantial portion of welfare usage, undermining the racially coded myths surrounding public assistance.

What remains constant is how immigrants are blamed for economic woes while quietly helping prop up the very system that targets them.

Who Really Benefits?

States rely heavily on federal subsidies to fund local benefits. Undocumented immigrants, by paying into the system without reaping equivalent rewards, are in effect subsidizing state governments and public services—schools, infrastructure, healthcare—without recognition, rights, or returns.

This contradiction is stark: immigrants pay in, but cannot cash out. Instead of appreciation, they face raids, deportations, and vilification.

The Bigger Question: What Does Privacy Mean?

When a government body like the IRS chooses to breach its own code of confidentiality, it sets a precedent not just for immigrants, but for every taxpayer. What does it mean to claim a Right to Privacy if those rights are politically negotiable?

And what message does it send to millions of people who did the “right” thing—filed taxes, gave up their private data, trusted the system?